Challenges in the Philippine Logistics Industry

An Overview of the Philippine Banking Industry

Most bank lending workflows involve methods of assessing creditworthiness of borrowers. CreditBPO Rating Report© is designed to automate borrower pre-clearance.

Credit Rating for Business Loans at match.creditbpo.com

When it comes to securing a business loan, your credit rating is one of the most important factors lenders will consider. Improve your access to credit by getting your CreditBPO Rating Report at match.creditbpo.com !

The Importance of Understanding Your Bank's Customers Through Market Evaluation

The Partnership Project of CreditBPO and DTI-NCRO

A Memorandum of Agreement (MOA) was signed between Lia Francisco, CEO/Founder of CreditBPO Tech Inc. and Marcelina S. Alcantara, Regional Director of Department of Trade and Industry-National Capital Regional Office (DTI-NCRO) in order to finalize the partnership project between CreditBPO and DTI-NCRO. Officials by both companies witnessed the event. CreditBPO and DTI-NCRO have decided to jointly plan and implement events and programs that support Small & Medium Enterprises ("SMEs").

CreditBPO and DTI-NCRO held the virtual signing to document their partnership. Here, Ms. Francisco and Ms. Alcantara first displayed the first page of the signed MOA.

The Shipping and Logistics Industry: How Technology is Enabling Business to Thrive

A shipping and logistics company is responsible for the transportation of goods from one place to another. This can include anything from raw materials used in manufacturing to finished products that are ready for retail.

The shipping and logistics industry has always been an important part of the global economy, critical to the growth of any economy. And it's only becoming more important as our world becomes increasingly connected. The efficient and timely movement of goods and materials is essential for the production and distribution of products and services….

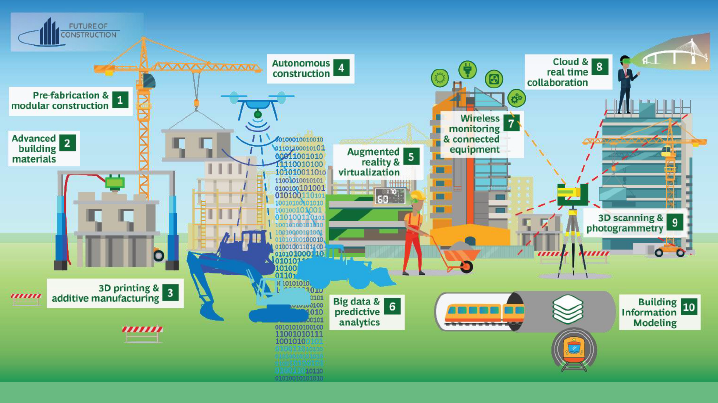

Contractor Accreditation: How Important Is It In The Philippine Construction Industry?

The Philippine construction industry is one of the most vibrant in the world. It is constantly in need of new talent and new ideas, and there are plenty of opportunities for those who are looking to get into the business. However, in order to be successful in this industry, it is important to understand the current state of affairs. In this article, we will discuss contractor accreditation and its importance in the Philippine construction industry.

CreditBPO Wins in ECCP's Europa Awards

Financial technology company CreditBPO has won the Green and Inclusive Finance Solutions category in the first Europa Awards 2021 on June 10, 2021.

CreditBPO was recognized for its active support to businesses engaging in green projects by promoting and supporting the flow of financial instruments and other related services for the development and implementation of sustainable business models, green investments, and policies promoting sustainability.

How to Purchase a CreditBPO Rating Report®

Financial condition analysis need not cost you an arm and a leg. This is why we are offering the CreditBPO Rating Report® at a fraction of the cost you would normally pay a financial consultant for the same insight.

Reports on select Philippine Stock Exchange-listed companies and Construction Industry Authority of the Philippines-accredited contractors are now available for purchase on the CreditBPO website.

How Lenders Can Achieve a More Robust SME Loan Pipeline

How much value does your bank or financial institution place on insights from the analyses of audited financial statements for your credit evaluation process? The answer will probably vary from one bank to another, with the need to obtain from business borrowers and maintain on file updated financial statements the only commonality.

Some banks and financial institutions view audited financial statements as understated, mostly because these are audited for tax purposes, and use qualitative measurements, such as whether another bank has already lent to a particular borrower, in their evaluation of business loan applications. This is dangerous as banks have different risk tolerances and collateral arrangements with their business customers.